BEIJING, Oct. 18, 2025 (GLOBE NEWSWIRE) — On the cusp of the conclusion of the “14th Five-Year Plan” and the commencement of the “15th Five-Year Plan”, China Duty Free Group (CDFG), a leader in China’s travel retail industry, along with Beijing DATA 100 information technology Co. Ltd., has released its CDFG Consumer White Paper (referred to as the “White Paper”). Drawing on real consumption data and informed by industry performance, macroeconomic trends, and duty-free policies, the White Paper offers deep insights into how the industry is recovering. It comprehensively analyzes the value of CDFG’s users and members, the characteristics of the nine key customer segments, the value upgrade paths for five core categories, and offers an outlook on future development.

The White Paper points out:

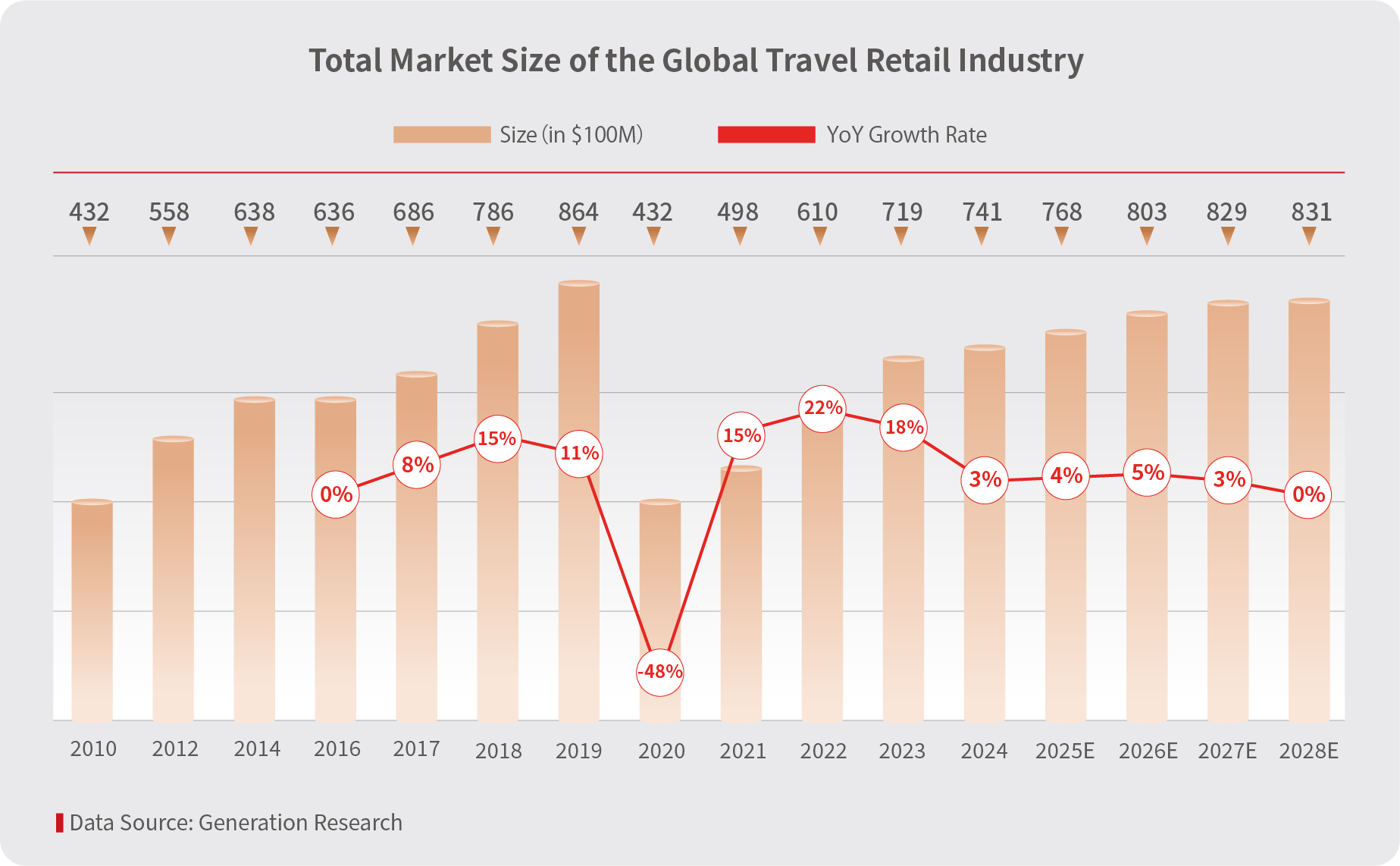

- Global Market Maintains Recovery Momentum. In 2024, the global duty-free and travel retail market reached a scale of $74.13 billion, a YoY (Year-on-Year) increase of 3%, recovering to 85.8% of its 2019 level. This rebound is driven by a confluence of factors, including the recovery of international tourism, policy support and market liberalization, the rise of emerging markets, and digital transformation, continuously invigorating the industry.

Source: CDFG Consumer White Paper 2024-2025 - China’s Market Highlights Its High-Potential Foundation. China’s GDP has returned to healthy growth after a period of adjustment. The combined effect of supportive policies and expanding domestic demand has stabilized consumer confidence, providing a solid foundation for the industry. Market expansion was driven by the optimization of Hainan’s offshore duty-free policy, the advancement of downtown duty-free shop policy, and growth in domestic and international tourism, as well as increased inbound consumption.

- CDFG’s Omnichannel Ecosystem Strategy Delivers Results. In the Chinese market, industry concentration continued to increase, with CDFG further strengthening its leadership with a 78.7% market share. Leveraging its advantages in industry leadership, omnichannel layout, supply chain, member value management, and capital and technology drivers, CDFG, along with its numerous partners, achieved higher-quality development in 2024

Source: CDFG Consumer White Paper 2024-2025 - CDFG’s User Base Achieves Breakthrough Growth, with Strong Performance from Foreign Users. In 2024, the total user base reached 104 million, a YoY increase of 26.1%. Foreign users grew particularly rapidly, with the number of users growing by 53.9% and their spending increasing by 84.5%.

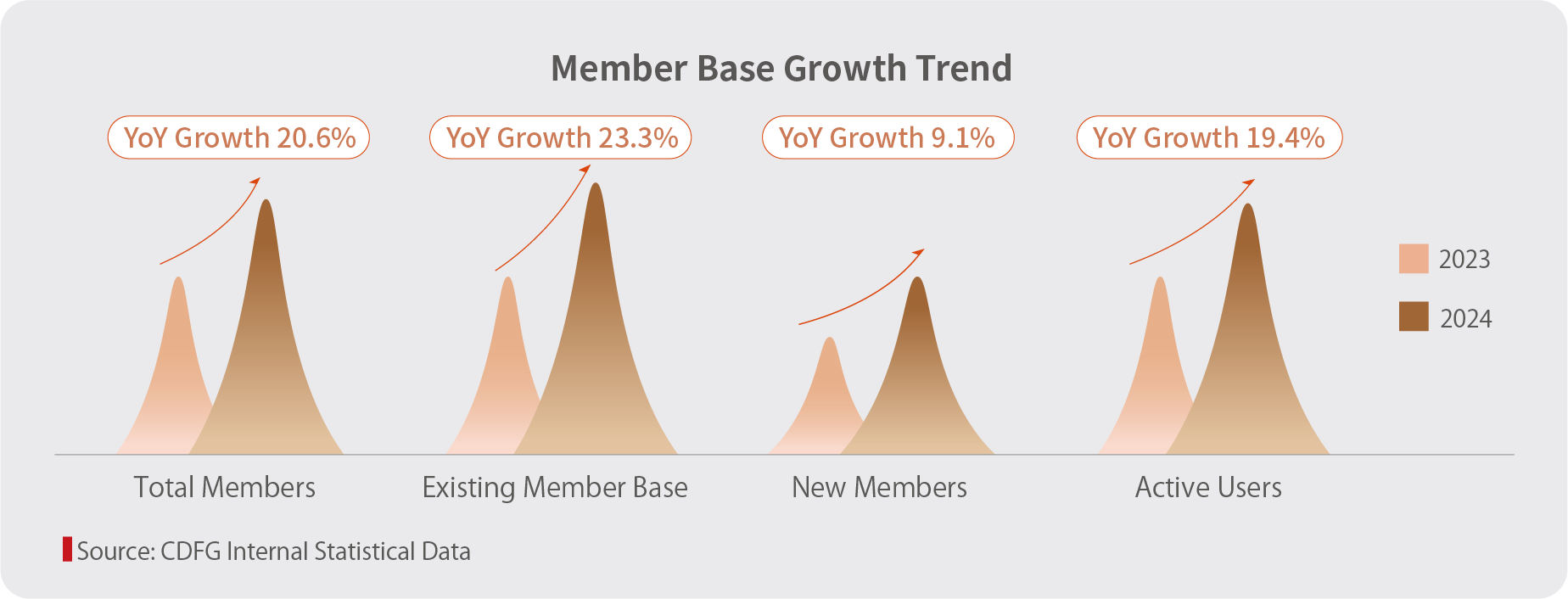

- CDFG’s Total Membership Continues to Grow, With A Significant YoY Growth Rate and A Stable Month-on-Month Increase. The 2024 YoY increase in the number of active members is particularly prominent, while their proportion of the overall membership remains stable. As of June 2025, CDFG’s membership has surpassed 45 million. Building on steady overall growth and a healthy structural adjustment, the member base exhibits three new traits: a solidified customer foundation across both mass and high-luxury segments; the emergence of men as a key growth engine for high-end consumption; and the increasingly evident purchasing power of the senior demographic.

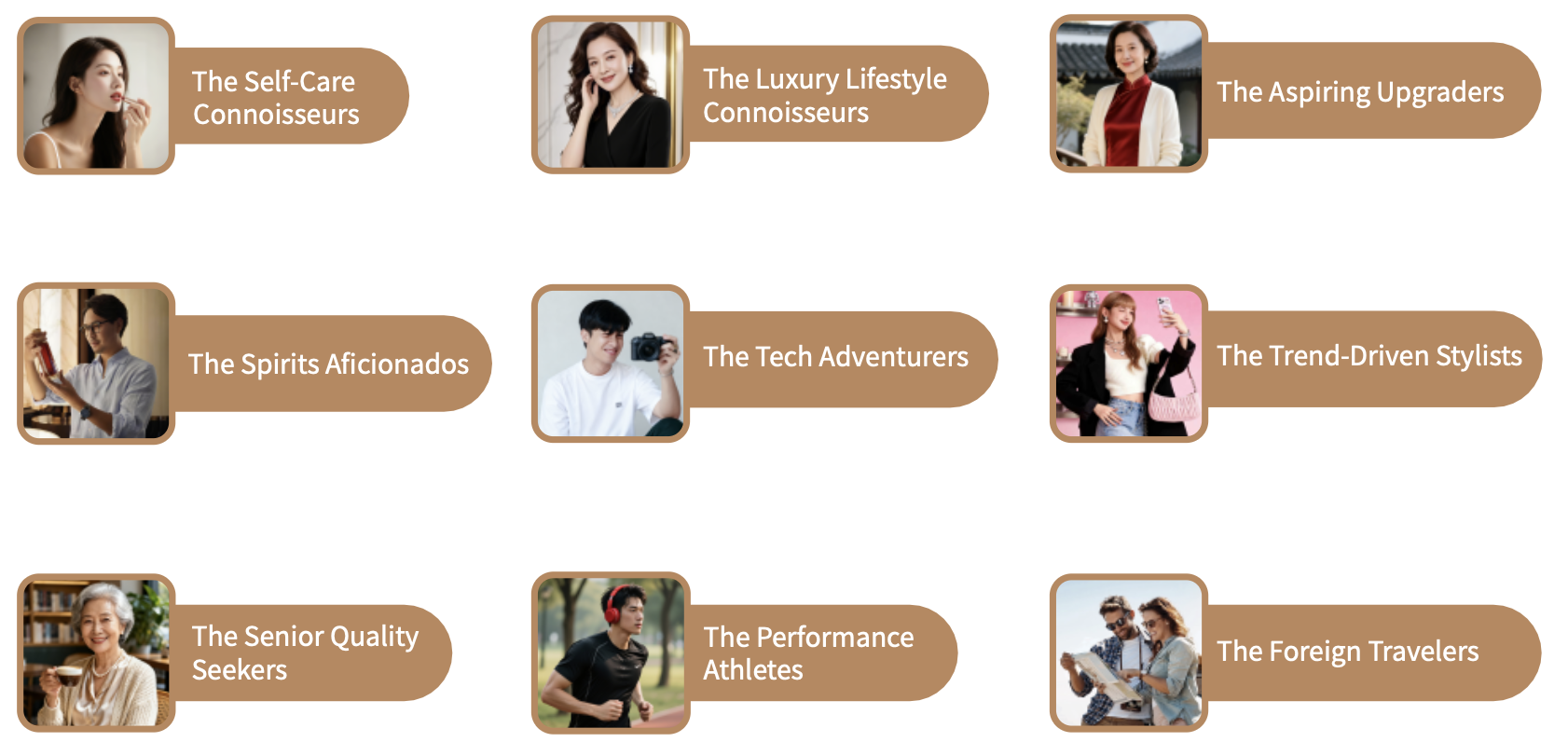

Source: CDFG Consumer White Paper 2024-2025 - Customer Base Reshaping: From “Scale Expansion” to “Meticulous Segment Cultivation”.Based on dimensions such as consumption contribution, category preference, age, and region, CDFG’s core customer base can be segmented into nine categories that precisely cover diverse consumption needs: The Self-Care Connoisseurs, aged 31-45 from first- and second-tier cities, focus on high-end skincare; HNW Luxury Lifestyle Connoisseurs favor watches and jewelry; The Aspiring Upgraders from third- and fourth-tier cities pragmatically pursue quality; male Spirits Aficionados aged 31-50 are keen on premium liquor; The Tech Adventurers aged 21-35 focus on technology products; Gen Z Trend-Driven Stylists aged 16-30 follow makeup trends; The Senior Quality Seekers aged 60+ prioritize health-related consumption; The Performance Athletes aged 26-45 choose professional gear; and The Foreign Travelers favor products with unique Chinese characteristics. The distinct consumption preferences of each group drive consumption upgrading and meticulous segment cultivation.

Source: CDFG Consumer White Paper 2024-2025 - Consumption Growth Shows New Trends: “The Rise of Guochao (China Chic)”, “The Experience Economy”, and “Channel Integration”.Through product innovation and cross-over collaborations, domestic brands have achieved a breakthrough in brand premium within the travel retail market. The enthusiasm of young consumers for “Guochao” products is changing the long-standing dominance of international brands in the travel retail market, creating new points of value growth. Experiential elements like immersive displays and art installations are upgrading duty-free shopping from a transactional activity to a form of content consumption. This shift requires operators to transform from merchandise suppliers to curators of lifestyle experience. The boundaries between online and offline channels are dissolving. Innovative initiatives such as the application of AR/VR technology and online-exclusive SKUs (Stock-Keeping Units) are building a new consumption loop of “Online Ordering + Offline Experience”. This integration not only enhances conversion efficiency but also redefines the spatio-temporal dimensions of duty-free shopping.

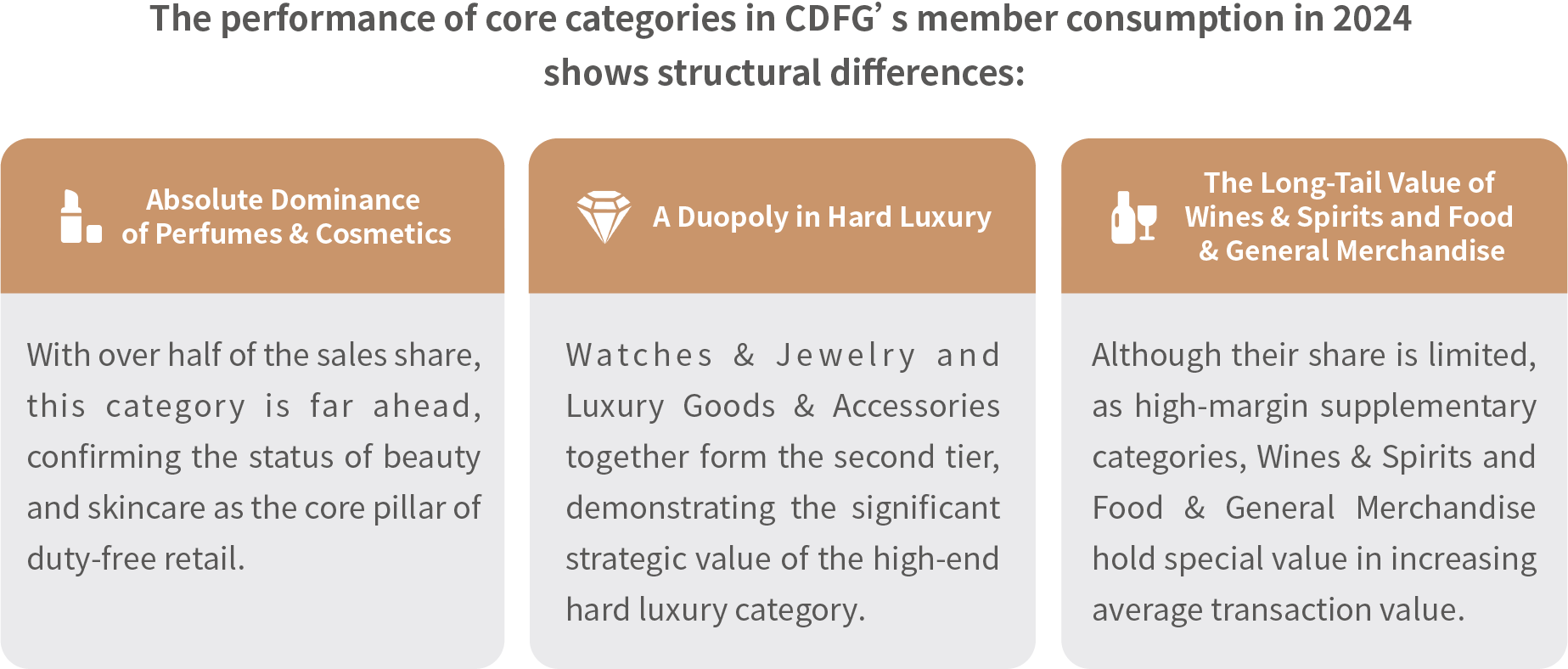

- Category Consumption Reveals a New Landscape: “Beauty Dominates”, “Hard Luxury Holds Ground”, and “Wines & Spirits Breaks Through”. – In Fragrances & Cosmetics, makeup and fragrances show remarkable growth, with foreign travelers, male customers, and Guochao brands emerging as key growth drivers. CDFG enhances repeat purchases through offline customized skincare solutions and online precision outreach.

– In Luxury Goods & Accessories, the consumption structure has diversified. The ultra-high-end market shows significant growth, while the affordable luxury segment maintains stable demand. CDFG secures high-end clientele with exclusive services such as personal shopping assistance and flight ticket reimbursement.

– In Watches & Jewelry, there is significant category divergence. The jewelry category shows YoY growth, while demand for watches exhibits strong regional characteristics.

– In Liquor, the market is undergoing both expansion and upgrading. Consumption is clearly stratified across categories and demographics, and channels are developing in a complementary fashion, showcasing a clear trend of simultaneous scale expansion and structural upgrading.

– In Food & General Merchandise, the market is expanding steadily with distinct segment characteristics. Gen Z and the senior demographic are driving a transformation in emotional and health-related consumption. CDFG is implementing a targeted strategy of “Guochao brands + niche scenarios” to precisely match the needs of these segments.CDFG has established a product matrix of over 360,000 SKUs across all categories, including Luxury Goods & Accessories, Perfumes & Cosmetics, and Liquor & Tobacco. In 2024, the Group successfully introduced over 200 new brands and exclusively launched over 500 limited-edition products across 19 collections, continuously enhancing its merchandise competitiveness.

Source: CDFG Consumer White Paper 2024-2025 - The Duty-Free and Travel Retail Market Is Set for Continued Advancement. Industry Opportunities: Structural Opportunities Emerge, Recovery Trend to Continue; Marketing Opportunities: Targeting Nine Key Segments and Breaking Through with a “Contextual Customer Acquisition – Immersive Conversion – Emotional Retention” Model

In the future, CDFG will use its digital-intelligence ecosystem as a core driver to deepen the “Duty-Free + Culture, Commerce, Sports, Tourism, and Health” integration. This will involve joint marketing initiatives tied to art exhibitions, sporting events, and celebrity performances to create immersive consumption experiences. At the same time, it will remain customer-centric, conveying the brand value of “YOUR WORLD OF DELIGHT” through stratified operations, the supply of rare goods, and omnichannel services, thereby promoting the high-quality development of the industry.

For the full White Paper, please visit: https://www.data100.com/home/infoDetail?id=894&type=news

Contact Person:

Mr. Huang

Email: huangjiaolin@data100.com

Website: https://www.data100.com

Telephone: 400 6875 100

City: Beijing

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/9b3e6137-bb0d-4d6d-a4e8-99068ff9cbe5

https://www.globenewswire.com/NewsRoom/AttachmentNg/69054ba9-cdc6-42ee-852d-967eb2cfbed1

https://www.globenewswire.com/NewsRoom/AttachmentNg/d2a7f43e-4a93-4089-8624-09364a153df9

https://www.globenewswire.com/NewsRoom/AttachmentNg/38446d51-d6ff-49e0-9577-8bae7eb42972

https://www.globenewswire.com/NewsRoom/AttachmentNg/66556a26-448e-493a-82e6-3d767acf2768

https://www.globenewswire.com/NewsRoom/AttachmentNg/5861e7fe-bd18-432a-90de-fc75e8cdd8de