Pune, March 24, 2025 (GLOBE NEWSWIRE) — BOTOX Market Size & Growth Analysis:

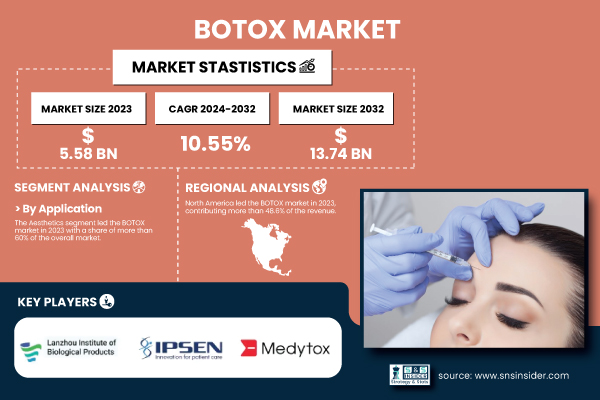

According to SNS Insider, the global BOTOX Market was worth USD 5.58 billion in 2023 and is anticipated to be worth USD 13.74 billion by 2032, at a CAGR of 10.55% from 2024 to 2032. Increasing demand for minimally invasive aesthetic treatments and the growing application of botulinum toxin in the healthcare industry are major drivers for the growth. Growing disposable incomes, social media trends, and advances in cosmetic dermatology have substantially accelerated the use of BOTOX treatments across the globe.

In the United States, the market for BOTOX is highly dominant, bringing in a significant percentage of revenues worldwide. As per the report by the American Society of Plastic Surgeons, more than 4.4 million botulinum toxin treatments were administered in the U.S. in 2023, further solidifying its position as the most used minimally invasive cosmetic treatment. The U.S. has also witnessed growing use of BOTOX in medicine, such as in the management of chronic migraines, muscle conditions, and excessive sweating, further fueling market growth.

Get a Sample Report of BOTOX Market@ https://www.snsinsider.com/sample-request/3319

Major Players Analysis Listed in this Report are:

- AbbVie Inc. – Botox

- Lanzhou Institute of Biological Products Co., Ltd. – BTXA

- Ipsen Pharma – Dysport

- Merz Pharma – Xeomin

- Medytox – Coretox, Innotox

- GALDERMA – RelabotulinumtoxinA (under development)

- HUGEL, Inc. – The Chaeum Toxin (formerly Wellage Toxin)

- Evolus, Inc. – Jeuveau

- Revance Therapeutics, Inc. – Daxxify

- Supernus Pharmaceuticals, Inc.

BOTOX Market Report Scope

| Report Attributes | Details |

| Market Size in 2023 | US$ 5.58 billion |

| Market Size by 2032 | US$ 13.74 billion |

| CAGR | CAGR of 10.55% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Key Regional Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East]), Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

Segment Analysis

By Application:

The Aesthetics segment dominated the BOTOX market in 2023, accounting for more than 60% of the overall market share. This is driven by the rising demand for facial rejuvenation treatments, such as wrinkle reduction and contouring treatments. Aesthetic uses continue to increase due to rising consumer awareness and social acceptance of cosmetic treatments.

The Therapeutics segment is experiencing accelerated growth, led by the rising application of BOTOX to treat medical conditions like chronic migraines, spasticity, and hyperhidrosis. The efficacy of botulinum toxin in treating neurological disorders has triggered additional research and expanded clinical use.

By Type:

Botulinum Toxin Type A dominated the market with the highest share in 2023, contributing over 85% of total revenue. Its established efficacy and extensive use in both aesthetic and therapeutic indications render it the preferred option among medical professionals.

Botulinum Toxin Type B is developing as the fastest-growing segment, with research ongoing to develop its applications for alternative therapeutic uses, especially for curing neurological illnesses and movement disorders.

By End-User:

Specialty & Dermatology Clinics dominated the market in 2023, accounting for more than 57.2% of overall revenue. The increased desire for expert-performed, outpatient cosmetic treatments has driven the demand for BOTOX procedures in specialty clinics.

Hospitals & Clinics are undergoing the most pronounced growth since the integration of botulinum toxin-derived treatments within regular healthcare environments keeps expanding. Widespread clinical use in both neurology and pain treatment fuels increasing adoption across hospitals.

Need Any Customization Research on BOTOX Market, Enquire Now@ https://www.snsinsider.com/enquiry/3319

BOTOX Market Segmentation

By Application

- Therapeutics

- Chronic Migraine

- Spasticity

- Overactive Bladder

- Cervical Dystonia

- Blepharospasm

- Others

- Aesthetics

By Type

- Botulinum Toxin Type A

- Botulinum Toxin Type B

By End-user

- Specialty & Dermatology Clinics

- Hospitals & Clinics

- Others

Regional Analysis

North America led the BOTOX market in 2023 with over 48.6% of total revenue. The region benefits from high disposable incomes, a growing demand for aesthetic treatments, and the presence of dominant market players like AbbVie (Allergan Aesthetics). The U.S. is the prime revenue driver, backed by a robust aesthetic medicine sector and FDA-approved medical uses of botulinum toxin.

Asia-Pacific is expected to witness the fastest growth, supported by growing awareness of cosmetic procedures, higher disposable incomes, and cultural desires for youthful looks. China, Japan, and South Korea are among the countries leading the adoption of BOTOX procedures in the region.

Recent Developments

- October 2024: Allergan Aesthetics (AbbVie) announced FDA approval for BOTOX Cosmetic to treat moderate to severe platysma bands (vertical neck bands), expanding its aesthetic indications beyond facial treatments.

- September 2024: Allergan Aesthetics launched the next phase of its 2024 BOTOX Cosmetic grant program, empowering 20 women entrepreneurs through crowdfunding initiatives.

- September 2024: Allergan Aesthetics introduced BOTOX Cosmetic for Masseter Muscle Prominence (MMP) in China, addressing the growing demand for facial contouring in the Asian market.

- February 2025: Evolus reported a 30% increase in Q4 2024 sales, reaching USD 79 million, with strong projections for 2025. The company anticipates FDA approval of new injectable hyaluronic acid gels in Q2 2025.

Statistical Insights and Trends

- In 2023, over 4.4 million BOTOX injections were performed in the U.S. alone, making it the most common minimally invasive cosmetic procedure.

- The adoption of BOTOX for medical applications is increasing, with over 1 million BOTOX-based therapeutic treatments performed annually for conditions such as chronic migraines and muscle disorders.

- The rise in disposable income and healthcare expenditure is fueling BOTOX adoption, with the U.S. market seeing a 12% year-over-year increase in aesthetic treatment spending in 2023.

Buy a Single-User PDF of BOTOX Market Analysis & Outlook Report 2024-2032@ https://www.snsinsider.com/checkout/3319

Table of Contents – Major Key Points

1. Introduction

2. Executive Summary

3. Research Methodology

4. Market Dynamics Impact Analysis

5. Statistical Insights and Trends Reporting

6. Competitive Landscape

7. BOTOX Market by Application

8. BOTOX Market by Type

9. BOTOX Market by End-user

10. Regional Analysis

11. Company Profiles

12. Use Cases and Best Practices

13. Conclusion

Access Complete Report Details of BOTOX Market Analysis & Outlook 2024-2032@ https://www.snsinsider.com/reports/botox-market-3319

[For more information or need any customization research mail us at info@snsinsider.com]

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company’s aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.